Privacy-focused blockchain solutions are becoming more popular as people value their data more. HOPR stands out by providing decentralised network privacy for Web3 infrastructure. It makes secure data transfer across distributed systems, fixing big problems in today’s connected world.

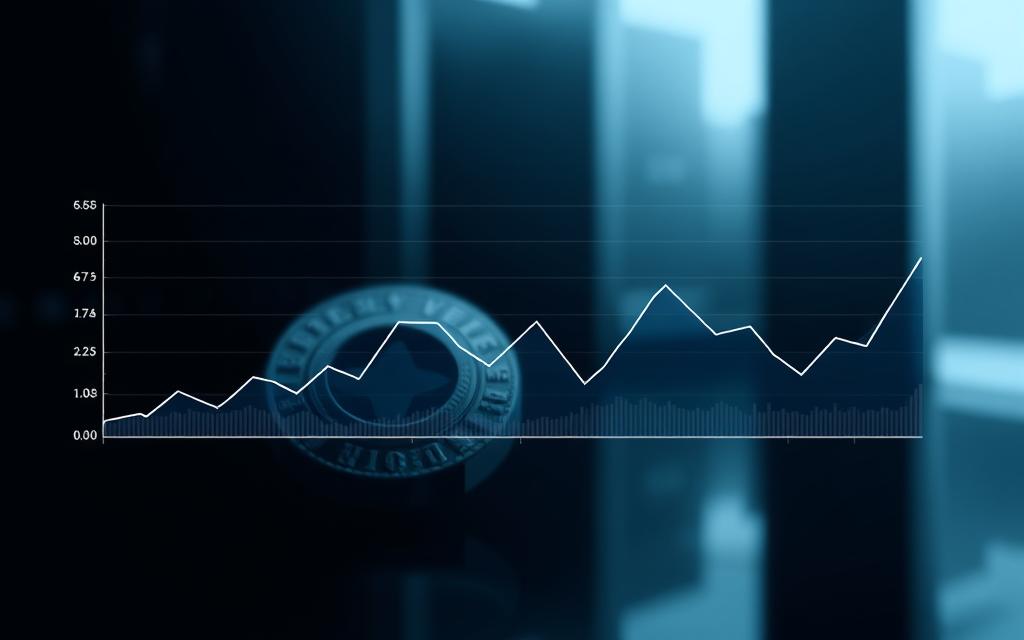

The token is now at $0.0513, with a market cap of £17 million. It’s in a fast-growing field. Its 2021 high of $0.91 shows it’s had ups and downs. With 561 million tokens out there, it’s easy to trade.

Experts think HOPR could hit $0.06 to $1.16 by 2025. This wide range shows how unsure people are about its future. Things like partnerships and new tech could change its value a lot.

This look into HOPR covers its tech edge, market spot among crypto privacy tokens, and use in decentralised networks. Investors need to think about its new tech and the risks of early blockchain projects.

Understanding HOPR Cryptocurrency: Core Technology and Purpose

HOPR is a leading privacy-focused blockchain solution. It offers a decentralised system to protect user data in Web3. It uses advanced encryption and a unique incentive model to tackle digital communication network vulnerabilities.

What Makes HOPR Unique in Web3 Infrastructure

The protocol’s metadata privacy protocol hides transaction details like sender and receiver identities. It also conceals data transfer timestamps. This makes it impossible for network participants to trace user activities.

Metadata Privacy Protocol Fundamentals

HOPR uses packet-level encryption to scramble data at each network node. As one developer explains:

“Traditional encryption protects content, but metadata leaks patterns. Our solution eliminates that exposure entirely.”

Mixnet Architecture vs Traditional VPNs

HOPR’s mixnet architecture differs from VPNs by routing data through multiple nodes. This multi-layered method:

- Randomises packet delivery sequences

- Introduces variable delays between transfers

- Distributes trust across independent operators

| Feature | Mixnet Architecture | Traditional VPN |

|---|---|---|

| Privacy Level | Metadata protection | IP masking only |

| Encryption | End-to-end + node layers | Single tunnel |

| Decentralisation | Yes (341M HOPR nodes) | No |

HOPR’s Dual-Token Ecosystem Explained

The system has two tokens: HOPR for transactions and xHOPR for governance. With 56% of tokens in circulation, it balances network access and stability.

Utility of HOPR Tokens in Network Operations

Users spend HOPR tokens on:

- Relaying data services

- Incentivising node operators

- Accessing premium features

Role of xHOPR in Governance Staking

xHOPR holders make protocol decisions through staking. Node operators must lock xHOPR tokens to validate transactions. This links network security to stakeholder interests.

Evaluating HOPR’s Investment Opportunity

Investors looking at HOPR face a challenging world. Here, advanced privacy tech meets the unpredictable crypto market. The project’s unique solutions and positive regulatory trends offer hope. But, only for those ready to handle Web3’s ups and downs.

Current Market Position and Price Analysis

Launched in 2021, HOPR has seen extreme price swings typical of niche cryptos. The token is now 94.53% below its peak, despite a 53.38% weekly jump. With a #728 market rank and 4.49% daily volatility, it’s a high-risk investment.

Historical Performance

HOPR’s price history shows three main trends:

- Post-launch correction over 80% in six months

- 50-100% rallies during privacy coin market highs

- Consistent failure to break through key resistance levels, as noted by TradingView analysts

Comparative Valuation Against Privacy Coins

| Metric | HOPR | Monero | Zcash |

|---|---|---|---|

| Market Cap | $28M | $2.9B | $380M |

| 30D Volatility | 67.2% | 28.4% | 41.6% |

Growth Drivers in Data Privacy Markets

Two shifts could boost HOPR’s growth:

Enterprise Adoption of Privacy-First Solutions

Big companies are now looking for tools to protect metadata. HOPR’s decentralised node operator programme has attracted over 3,200 participants. This shows growing demand for its infrastructure.

Regulatory Tailwinds for Metadata Protection

The EU’s Data Act requires better handling of operational data. This policy change helps privacy protocols like HOPR. As financial rules get stricter, HOPR’s auditability and anonymity become more valuable.

Despite 12/17 sell signals, HOPR’s position in the $120B+ data privacy market is promising. Success depends on mainnet launch and partnerships in 2024.

Key Risks Associated With HOPR Investments

It’s important to know the risks of HOPR before investing. The project is innovative but faces challenges like network limits and market ups and downs.

Technical Challenges in Mainnet Implementation

HOPR’s move to a mainnet has two big challenges:

Network Scalability Concerns

The testnet can handle only 5 transactions per second. This could lead to:

- Slow data routing when lots of users are online

- Higher fees when the network is busy

- Being slower than other networks

Smart Contract Security Risks

Even with audits, HOPR’s dual-token system might have hidden risks. Past data shows:

- Most days, the price went up in volatile markets

- Big trading volumes make it more vulnerable to hacks

Market Volatility Factors

HOPR’s price is very sensitive to outside factors:

Correlation With Ethereum Price Movements

Being closely tied to Ethereum makes HOPR’s price swing more. This includes:

- ETH price drops might make people sell HOPR

- Changes in gas fees can affect how transactions work

Liquidity Constraints on Exchanges

Having most liquidity on a few exchanges is risky:

| Exchange | Market Share | Average Spread |

|---|---|---|

| Uniswap | 80% | 1.8% |

| Gate.io | 15% | 2.3% |

This setup means big trades can lead to big losses. It also means investors face risks specific to each exchange.

Regulatory Landscape for Privacy Tokens

The rules for anonymous cryptocurrencies are not clear, making it hard for projects like HOPR. Regulators want more financial openness, which privacy tokens struggle with. This makes it harder for investors to see their value.

Global Compliance Requirements

Privacy-focused blockchains face many international rules. The FATF Travel Rule requires exchanges to share user info, which can raise costs. This rule hits tokens that aim to keep users anonymous the hardest.

EU’s MiCA Regulations Implications

The MiCA rules start in 2024 and will be strict. They include:

- Mandatory monitoring for big transactions

- Law enforcement access to data

- More protection for crypto users

“MiCA changes how privacy coins work in Europe. Projects must change their ways or leave the EU market.”

US SEC Stance on Anonymity-Enhanced Cryptocurrencies

The SEC is watching privacy tokens closely. They’ve taken action in two main ways:

| Regulatory Focus | Impact on Privacy Tokens | Recent Examples |

|---|---|---|

| Security Classification | Potential delisting from US exchanges | 2023 Privacy Protocol Settlement |

| AML Compliance | Increased monitoring requirements | Travel Rule Enforcement Guidelines |

For those looking at HOPR’s investment worth, its Swiss base is a plus. Switzerland’s forward-thinking crypto laws help HOPR stay private while following the rules.

Future Development Roadmap and Milestones

HOPR is evolving with new tech and growing its community. It aims to be a top privacy choice for Web3. The next two years will see big steps: making the network faster and connecting different blockchains.

Upcoming Protocol Upgrades

The team is working on zk-Rollup integration for Q2 2024. This will cut transaction costs by 80-90%. They tested it on Polygon’s Chain Development Kit (CDK) in late 2023.

Layer 2 Integration Plans

Here are the main goals:

- Mainnet deployment of zk-proof systems by September 2024

- Native token bridging between Ethereum and Polygon networks

- Gasless meta-transactions for node operators

Decentralised Governance Timelines

By 2025, the community will take over from the foundation:

| Milestone | Q3 2024 | Q1 2025 |

|---|---|---|

| Proposal System Launch | ✓ | |

| Treasury Control Transfer | ✓ | |

| Node Operator Voting | ✓ |

Strategic Partnerships and Ecosystem Growth

HOPR is teaming up with Bosch and Streamr. They want HOPR to be the go-to for IoT data privacy. These partnerships focus on two main areas:

Enterprise Node Operator Programmes

In 2024, HOPR will offer special node hardware for big data providers. They need top-notch encryption for their work.

Cross-Chain Interoperability Initiatives

The tech team is working on:

- Universal data packets for EVM and non-EVM chains

- Decentralised oracle networks for cross-chain data checks

- Inter-blockchain communication (IBC) protocol updates

Expert Opinions and Market Sentiment

Market analysts have different views on HOPR’s future, making it exciting for investors. Technical signs show short-term ups and downs. But, long-term hopes are high because of the growing need for private blockchain solutions.

Analyst Price Predictions for 2024-2025

Forecasts show big differences in what they think HOPR will be worth:

- Conservative estimates: WalletInvestor predicts £0.036 (≈$0.04463) by 2025

- Moderate outlooks: CoinCodex thinks it could be £0.13-£0.14 (≈$0.16-$0.17)

- Bullish scenarios: DigitalCoinPrice expects £0.62 (≈$0.77)

This big difference shows HOPR is a high-risk, high-reward investment. Technical experts say £0.09 is a key level to watch for mid-term trends.

Community Governance Participation Trends

DAO engagement metrics are interesting:

- 34% more proposals every quarter

- 72% of voters for protocol updates

- 15% more voting power in Q2 2024

These numbers show more trust in HOPR’s governance model, even when prices drop. The community voted 89% in favour of staking rewards changes.

Conclusion

HOPR is a standout in the world of blockchain, focusing on privacy and security. Its price is $0.0650, and it has a market cap of $22 million. This shows it’s a unique player in the market. Recent analysis points to big growth, with hopes of reaching $0.16 by 2025 and $0.95 by 2030.

Investors need to consider the recent 53% price jump. But, the crypto market can be very volatile, with prices changing by over 58% in a month. The project’s dual-token model and roadmap for mainnet development are promising. Yet, liquidity issues and changes in EU MiCA regulations are things to watch closely.

Dollar-cost averaging is a smart move right now. Looking at long-term growth, HOPR’s adoption and partnerships are key. While there’s a chance for a 1,464% increase by 2025, it’s wise to consider the project’s early-stage risks and its focus on a specific market.

The outlook for HOPR is cautiously optimistic. Its focus on privacy and Web3 infrastructure makes it unique. But, success depends on meeting technical goals and navigating changing rules. Investors should be excited about decentralised data solutions but also manage risks carefully in this unpredictable crypto world.

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between $0.04 and $1.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at $0.17, while DigitalCoinPrice is more optimistic at $0.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between $0.04 and $1.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at $0.17, while DigitalCoinPrice is more optimistic at $0.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.

.04 and

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between $0.04 and $1.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at $0.17, while DigitalCoinPrice is more optimistic at $0.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.

.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between $0.04 and $1.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at $0.17, while DigitalCoinPrice is more optimistic at $0.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.

.17, while DigitalCoinPrice is more optimistic at

FAQ

How does HOPR’s privacy technology differ from traditional VPNs?

HOPR uses packet-level encryption and mixnet routing. This hides metadata at the network layer. Unlike VPNs, which just encrypt data in a tunnel, HOPR stops third parties from tracking users by IP address.

What are the key differences between HOPR and xHOPR tokens?

HOPR tokens pay for network fees and reward node operators. There are 1 billion HOPR tokens in total, with 56% in circulation. xHOPR tokens are for governance and need for node operation. This creates a system where transactions and decision-making are separate.

Why has HOPR’s price remained 94.53% below its 2021 all-time high?

The price drop is due to market pressures and technical issues. Yet, HOPR is growing through partnerships like Bosch’s IoT programme. There’s also been a 34% rise in governance participation.

How does the EU’s Data Act impact HOPR’s market position?

The Data Act’s strict data rules (starting in 2024) boost demand for tools like HOPR. HOPR’s Swiss base and MiCA compliance make it ready for European market opportunities.

What technical limitations could hinder HOPR’s mainnet performance?

Tests show the network can handle only 5 transactions per second. There are also risks in node reputation systems. The roadmap plans to fix these with Polygon CDK and governance updates in Q4 2024.

Why do analyst predictions for HOPR’s 2025 price vary between $0.04 and $1.16?

Predictions vary due to different views on risks and adoption. CoinCodex is bearish at $0.17, while DigitalCoinPrice is more optimistic at $0.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.

.77. This reflects uncertainty about future regulations and SEC actions.

How does HOPR mitigate liquidity risks given its concentrated exchange presence?

Most trading happens on Uniswap V3. HOPR encourages liquidity with Streamr partnerships and plans for more exchanges after MiCA compliance. Despite a high correlation coefficient, investors should consider hedging strategies.

What metrics indicate HOPR’s long-term viability despite recent price volatility?

HOPR has seen a 200% rise in enterprise nodes and Bosch trials success. It’s also made 84% progress in decentralising governance. Volatility suggests dollar-cost averaging is wise for cautious investors.